The Why, Where, What and How of Investing in U.S. Farmland

FarmInvest will help you navigate the entire journey from property selection, to determining the best legal and tax structure for acquisition, holding and operation of your U.S. farm investment and making it a reality.

U.S. Farmland - Why?

Safe Investment

First of all, farmland is a tangible, income producing asset. However, as opposed to other income-producing real estate investments, farmland is indestructible, cannot go up in smoke, become obsolete or loose most of its value. Farmland generally is low-maintenance, the necessary work is usually performed by the tenants. There is a low risk of irreparable damage and most risks can be economically insured.

Under All is the Land

The amount of land is finite. As Mark Twain said: "Buy land, they're not making it any more". Population and industrial growth continue absorbing farmland, leaving less and less acreage for agricultural production.

Property Rights

Property rights in the U.S.A. are strong and well protected. In most states, farmland ownership is accessible to foreign investors with little or no restrictions. For more information, please see comments titled "Accessible to Foreign Investors" below.

Safe Returns

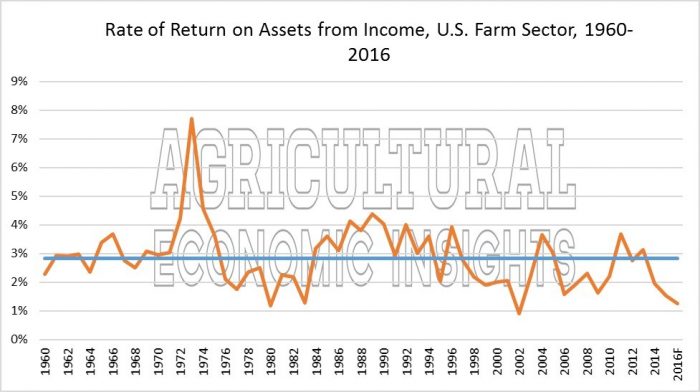

U.S. farmland generates consistent annual returns from operations/rents and through appreciation/capital gains. The rate of return from current income has ranged from a high of 7.7% (1973) to a low of 0.9% (2002).

Recently depressed commodity prices have resulted in lower returns, while land prices have remained relatively stable. However, the pressure on sales prices are now beginning to create attractive opportunities for investors.

Long-term returns of U.S. farmland from income and appreciation are comparable with stocks and bonds, but with the security of a tangible asset with limited supply. Tenant roll-over is generally low and tenants usually are easy to replace. Finally, rents can be legally secured through liens on the tenant’s crops and assets.

Protection from Inflation

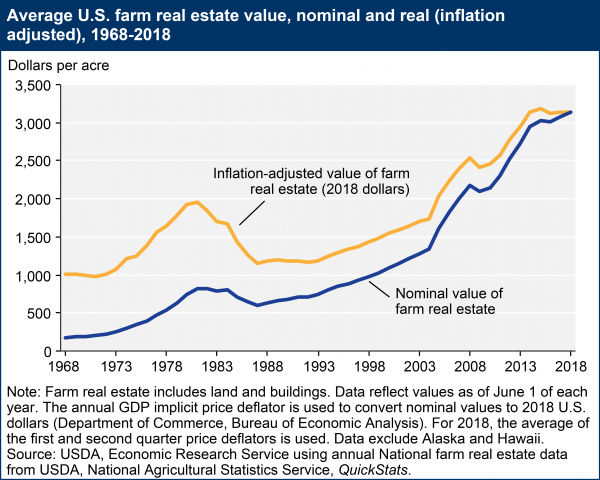

Over the past 50 years, i.e. from 1968 to 2018, U.S. farmland values increased at an average rate of 5.9% annually.

Historically, the single most valuable and stable form of property world-wide has been in the form of high-quality productive agricultural land.

Accessible to Foreign Investors

Most states allow foreign investors to acquire and own agricultural real estate. The states of the Mississippi Delta Region are Louisiana, Mississippi and Arkansas. The following applies:

| Foreign Individuals | Foreign Corporations | Comments | |

| Arkansas | No restrictions. | No restrictions. | Public lands can only be acquired by naturalized persons. |

| Louisiana | No restrictions. | No restrictions. | |

| Mississippi | Not allowed to own land. | No restrictions. | Non-resident aliens are neither allowed to own public land directly, nor indirectly |

Liquidity

Quality farmland is in high demand and usually can be disposed at market prices within just a few months.

U.S. Farmland - Where?

We are concentrating on the Mississippi River Delta Region, particularly the states of Mississippi and Arkansas for the following reasons:

Soils

The soils of the Mississippi River Delta have accumulated over thousands of years through annual flooding. This flooding, now controlled by an extensive levee system, deposited topsoil to a depth of more than 65 feet (20 m) in most areas. The region is known for its highly fertile soils and abundant underground water resources.

Topography

The Mississippi Delta alluvial plain consists of mostly flat land. This allows for economic precision leveling of fields, which increases productivity due to improved irrigation and drainage.

Climate

The region features a long growing season with moist springs, hot summers, dry falls and mild winters. The region has between 246 and 270 growing days per year.

Infrastructure

The region has an excellent and established agricultural infrastructure, including elevators, terminals, storage and handling facilities.

Water

The Mississippi River Delta Region has abundant water resources from rain, groundwater, and streams. In most areas groundwater is easily accessible in depths of 60 to 90 feet. The shallow Mississippi River Valley Alluvial Aquifer is the source of ~95% of irrigation water used in the Mississippi Delta. Permits are required for drilling wells and for pumping water from the aquifer and from streams.

Utilities

Electrical power and gas are widely and readily available at very economical prices.

Transportation

A well-developed network of roads, railroads and river barges allow for economical transportation of harvested crops to the markets.

Price Levels

Compared to the prices for cropland in California, the corn-belt and the Northeast, land prices in the Mississippi River Delta are still relatively low.

U.S. Farmland - What?

Overall Quality

The main criteria for quality farmland are as follows:

Soil Quality

For each county, the Natural Resources Conservation Service (NRCS) is publishing an extensive soil survey that is publicly available and allows for easy determination of the properties, qualities and limitations of the soils for any parcel of land.

Water Availabiliry

Even though annual rainfall may be high in the Delta region of the Mississippi River, only 30% occurs during the months in which the major crops are produced, making irrigation an important component of producing an excellent crop.

Drainage

The land needs to drain well in order to avoid standing water in the fields.

Location

Easy access and proximity to transportation and urban areas, including highways, railroads and river transportation are important factors.

Optimizing Risk and Return

Quality management and reputable tenants help minimizing risk and maximizing returns. Factors are:

Securing Income

Cash rents can be secured by recording a lien against the tenant, its crops and assets. It is also common practice to require a portion of the rent to be paid in advance at the beginning of the crop year.

Replaceability of Tenants

A defaulting tenant usually is relatively easy to replace.

Protection from Inflation

The investment value of farmland is well protected from inflation, because cash rent income ultimately will be adjusted for inflation.

Local Knowledge

Through our local presence we have access to prime assets through well-established connections.

Opportunity

The current market situation is still tight. There is high demand due to U.S. farmland having become increasingly popular with institutional and foreign investors. Properties rarely reach the open market and often are sold to local connections. Through our excellent connections within the local markets we encounter attractive opportunities that are not commonly available to outsiders.

U.S. Farmland - How?

Our team, in cooperation with its vast network of experienced professionals, can assist an investor in all aspects of selection, acquisition, operation, tax-matters, estate planning and disposition of U.S. farmland. We can assist you with all of these aspects, recommend professionals, and/or coordinate with your own consultants.

Property Selection

Quality farmland is in high demand and rarely reaches the open market through real estate brokers. Being immersed into the local market and having a dense network with excellent connections, FarmInvest gets access to information and properties that are available only to market insiders. Our experts quickly vet-out undesirable properties and help you select the rare gems as they become available.

Legal Structure

In order to protect and shield the investor from risk, farmland is best held through a legal entity, such as a U.S. Corporation (Inc.), Limited Liability Company (LLC), or trust.

Acquisition / Disposition

The acquisition and/or disposition process is usually handled through an attorney and a title agency that will inspect the title and provide title insurance for the property.

Management

Experienced and diligent management is essential for the success of any farm investment. Our farm managers have been working with us for over 35 years and provided excellent services to our clients. If ever necessary, we will be available to assist you in your communications with your farm manager and other professionals.

Tax Planning

Expert tax planning and structuring is essential for any investment. We are working with skilled experts who are experienced not only with the particulars of farm investments, but also with the specific needs of foreign investors.

Estate Planning

Ultimately, estate planning is crucial for any investor, and even more so for international investors in order to avoid unnecessary complications and estate taxes.

Coordination and Support

Last, but not least, we will always be available to answer your questions, facilitate communications, coordinate the work of your farm managers, legal, financial and tax counsels or any other professionals required for making your farm investment a success.